CRDB Bank's DRC Subsidiary to Foster Trade Relations and Enhance Economic Integration across East Africa

Looking at a truckload of merchandise leaving Dar es Salaam port for the DRC, Lubumbashi, Makale Mabombo is a happy man because, finally, he has cleared his goods. "It wasn't on time, but it's finally done," said the Congolese businessman who complained against delays in cargo clearance from the country's prime port.

Mabombo says one of the factors contributing to such delays is banking bureaucracy. "For payment to be processed from Congolese banks in Kinshasa to Tanzania Ports Authority and Tanzania Revenue Authority, it takes days instead of hours," he lamented, saying such red tape also affects the efficiency of the port and burdens consumers with high prices of goods.

But Mabombo, like many other DRC businesspeople who use Dar es Salaam port as a gateway to the global market, relief is in sight as CRDB Bank Plc opens its doors in Lubumbashi by mid-this year.

"The integration of digital payment systems between CRDB Bank and Tanzania Port Authority will lead to increased efficiency in transactions and result in a significant boost to bilateral trade. This is a big relief for us," he remarked. He also commended CRDB Bank's expansion into DRC, stating that it would further stimulate trade.

The Tanzania Port Authority (TPA) and CRDB Bank's digital payment system, aligns well with President Samia Suluhu Hassan's promise on economic diplomacy and opening up the country to foreign trade and investment, will facilitate both increased bilateral trade and investment between Kinshasa and Dodoma.

TPA's Director General, Plasduce Mbossa, and Tanzania Freight Forwarders Association (TAFFA) president, Edward Urio, said that CRDB Bank's commencement of operations in the vast central African nation will also boost traffic at Dar es Salaam port.

Mbossa said in remarks after CRDB Bank and TPA agreed to digitize payments at Dar es Salaam port that traders from DRC, Dar es Salaam port's second largest cargo client, will easy payment for their cargo and port services from anywhere.

He said the system will simplify port operations as customers will be issued with a 'control number' to facilitate all port fee payments while recording every transaction made in real-time. "The system will reduce the bureaucracy associated with manual transactions hence removing queues for payment port charges at banking halls," the TPA chief noted. Official figures from TPA indicate that the DRC cargo transiting through the country's prime port constitutes between 35 and 40 percent as of last year.

Mbossa said the target is to increase DRC's volume of cargo transiting the port to 58 percent in the next two years. In fact, the country's port landlord targets to increase cargo passing through Dar port from 1.9 million tonnes in 2020/21 to three million during the period.

Seconding the TPA boss' arguments, TAFFA's Urio said the digitised system will boost trade with DRC and other landlocked countries and improve efficiency and the prime port.

"This system will revolutionise port services payments which for a long time were clogged in red tape hence delayed cargo clearance," Urio said, noting that CRDB and TPA are speeding up the implementation of president Samia's ambition to open up the country and boost trade and investment.

"We thank the government because its incentives for adopting digital payments have triggered an all-time high acceptance by stakeholders of the port community, including TAFFA," he observed.

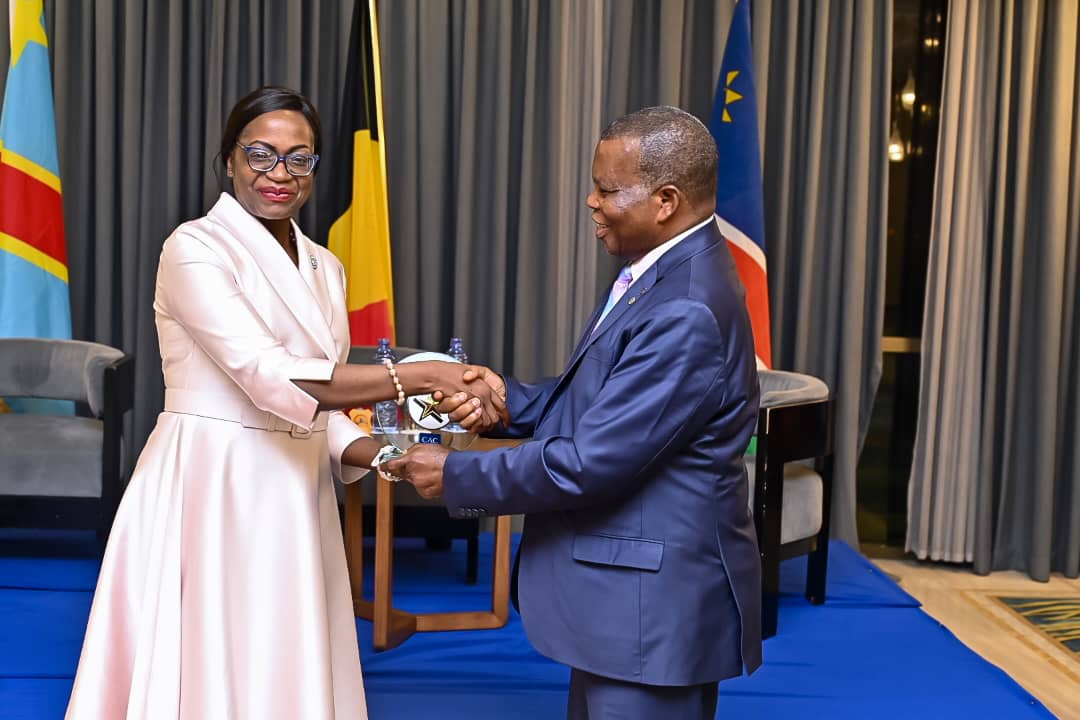

CRDB Bank DR Congo S.A. Managing Director, Jessica Nyachiro, said their experience over the years convinced them to advise TPA management to digitize the payment systems to curb losses while simplifying payment services for customers.

"We are proud to be part of TPA's digital payment system, which will enable customers to make payments worldwide online, which makes us the first bank to integrate our services with TPA in the country," Nyachiro said.

She said the system also addresses several manual platform loopholes, including charging the wrong rate for cargo consignments, as it also converts foreign currency automatically without human intervention.

The CRDB Bank's DR Congo S.A. chief further noted that the Dar es Salaam based lender has always been at the forefront of creating a trusted payment gateway and is leading the effort to build a digitally empowered socio-economic ecosystem.

"We have been supporting the Government's agenda of establishing a digital economy and cash-less society through our innovative banking solutions," Nyachiro noted.

Tanzania's largest Bank is set to begin operating in the DRC before mid-year, and it has joined forces with NorFund of Norway and IFU from Denmark to establish its subsidiary in the vast central African nation. As per the memorandum of understanding signed among the partners in the middle of last year, CRDB Bank has a 55 percent investment, while IFU and NorFund each have 22.5 percent.

"DRC is the second largest customer of Dar es Salaam port, and CRDB Bank has for a long period of time been handling transactions of Congolese business people, and now we want to maintain our presence in Kinshasa," Nyachiro said.

She pointed out that good bilateral relations between Tanzania and DRC, backed by accommodative investment policies promoted by Presidents Samia Suluhu Hassan and Félix Antoine Tshisekedi Tshilombo, have convinced the Bank's management and board to establish a presence in the massive central African nation.

As a financial institution with a strong presence in the region, CRDB Bank is uniquely positioned to support businesses and promote economic development in East Africa. Nyachiro said CRDB Bank's subsidiary in the DRC will serve as a bridge between businesses in the DRC and other East African countries, facilitating cross-border trade and promoting greater regional integration.

DRC so far has 15 banks CRDB Bank be rates to 16. Nyachiro said the bank will spearhead the use of digital channels which will simplify local and cross border money transfer and speed up transactions while at affordable costs.

What's new?

BLOG

CRDB Bank targets bigger pie of East African Market

CRDB Bank's ambitions to become a regional powerhouse gained momentum in 2019 after the Board approv...

Read More