What's new

CRDB BANK IN NEWS

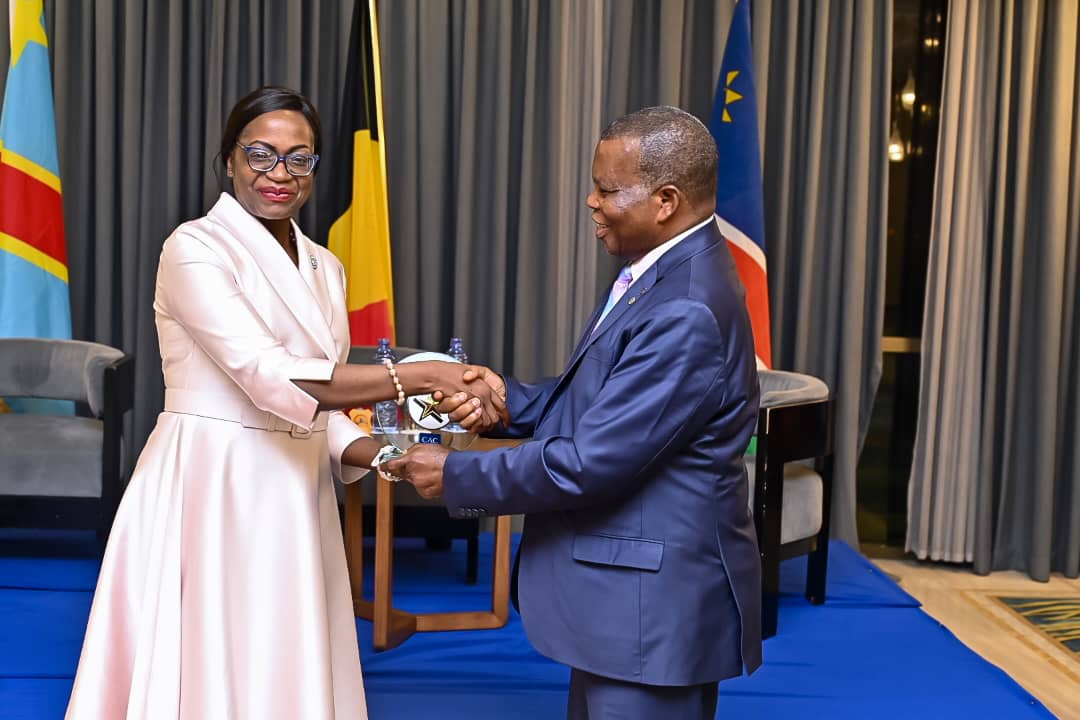

Award for Contribution to Empowering Women Entrepreneurs DRC

Managing Director of CRDB Bank DR Congo S.A., Ms. Jessica Nyachiro has been awarded an award in recognition of her contribution in empowering women entrepreneurs in the country. The award was given at the summit of the International Forum for Economic Capital and Sustainable Development organized by Credassur Connect and held in Kinshasa to discuss economic development, and the contribution of emerging businesses, especially those managed or owned by women. The Ambassador of Tanzania in the DRC, Said Mshana was among the speakers in the forum that brought together the leaders of the DRC Government, diplomats, directors of financial institutions and international organizations as well as other development stakeholders.

Learn MoreCRDB BANK IN NEWS

CRDB Bank get License to operate in DR Congo

The Central Bank of the Democratic Republic of Congo officially granted CRDB Bank a license during a meeting with the bank's management led by Chief Finance Officer, Mr. Fredrick Nshekanabo. Upon granting the license, the First Vice Governor of the Central Bank of Congo (BCC), Mr. Dieudonné Fikiri Alimasi, congratulated CRDB Bank Plc and declared that it will significantly enhance competition in the delivery of financial services in the DRC. According to the statement, Mr. Alimasi also stated that the BCC has also approved the appointment of Ms. Jessica Nyachiro as Managing Director of the CRDB Bank’s DRC subsidiary. Ms. Nyachiro affirmed that CRDB Bank will adhere to the demands and necessities of the DRC market just as it does with Tanzania and Burundi. She stated that CRDB Bank will establish a branch in Lubumbashi and progressively extend its reach to significant metropolises such as Kinshasa, Lualaba, Kasai, Tanganyika, and Likasi within the initial three years of its operations in the country. Our bank is investing heavily in digital systems and a network of branches, and we also expect to use alternative delivery channels such as Agency banking, Mobile Banking (Simbanking), and Internet banking to connect many Congolese people to our services," said Ms. Nyachiro.

Learn MoreCRDB BANK IN NEWS

CRDB Bank targets bigger pie of East African Market

CRDB Bank's ambitions to become a regional powerhouse gained momentum in 2019 after the Board approved the Group's entry into the Democratic Republic of Congo (DRC). The Bank is currently finalizing plans to launch operations in the DRC with a $30 million subsidiary. The investment is part of the Bank's regional expansion strategy, targeting the larger Eastern African market. The DRC subsidiary, which will be based in the commercial hub of Lubumbashi, is expected to commence operations within the second half of 2023. "We see the DRC as an exciting market since it provides a unique opportunity for our Bank to transform lives beyond our borders," said Abdulmajid Nsekela, CRDB Bank Group CEO & Managing Director. CRDB Bank has secured two equity partners, the Norwegian Investment Fund for Developing Countries (Norfund) and Investment Fund for Developing Countries-Denmark (IFU). CRDB Bank will hold a majority stake of 55%, while Norfund and IFU will each hold 22.5% equity. "CRDB Bank has demonstrated leadership in sustainability, especially in promoting sustainable communities, which makes it a viable investment for Norfund," said Mr. Espen Froyn, Vice President of Norfund. CRDB Bank is the first Tanzanian Bank to venture into the DRC, which is considered the country's biggest trading partner. Tanzania trades with DRC in various sectors, including agricultural and industrial produces. DRC also relies on the Port of Dar es Salaam in importing and exporting goods. In 2019, Tanzania and DRC inked a bilateral agreement to construct the Standard Gauge Railway connecting the two countries via Burundi. In 2012, CRDB Bank began implementing its ambitious plan to expand its operations beyond Tanzania's borders by venturing into the Burundi market. In Burundi, CRDB Bank found a nascent market thirsty for enterprise development and tapped into it – driving business and enterprise development. Fredrick Siwale, CRDB Bank Burundi Managing Director told our TemboNews correspondent that in the last ten years, the subsidiary has made great strides and climbed the market ladder to become the third largest Bank. The Bank currently has USD 19 million capital compared to 13 million US dollars when entering the Bujumbura market. Therefore, it was no surprise that during the tenth-anniversary celebrations, H.E. Evariste Ndayishimiye, the President of the Republic of Burundi, congratulated the CRDB Bank Burundi for its outstanding achievements been able to post over the ten years. "We value your dedication to assisting the government in financing various development sectors and increasing financial inclusion in the country. We wish to see you increase the integration of financial services to the people of Burundi, and the government is ready to continue supporting you in that area," said President Ndayishimiye. CRDB Bank Burundi offers services through its four branches, alongside over 600 banking agents spread across the country. The Bank plans to expand in 2023 by opening a branch in Gitega (the political capital), Makamba, and Ruyigi townships and is targeting to double the number of agents. The Bank's Group CEO and Managing Director, Abdulmajid Nsekela, said that the Bank plans to expand operations in other countries in the East and Central Africa region. He stated that the Bank is looking into acquisition and greenfield opportunities, noting that the plan is to use technology to penetrate the markets. "We need to leverage on technology rather than a physical presence that requires heavy capital investment. With partnership, technology will be key to our expansion and the differentiating factor," added Nsekela. CRDB has a 23.3 percent market share in deposits and 20.2 percent in loans in Tanzania's banking industry, with more than Tsh 10 trillion worth of assets, according to the financial statements for Q3 of 2022.

Learn More